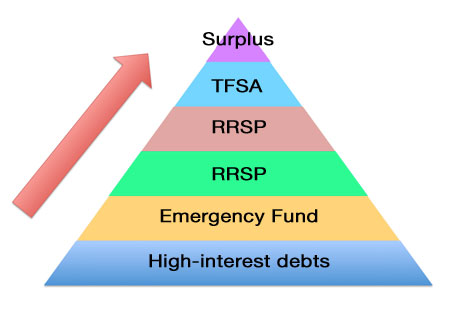

In what position should we place the RRSP and the TFSA in our order of priorities? After paying the mortgage? After raising a fund for the children’s studies? After all, do we really need it? This type of questions often come up and I think it is time to visualize more the use of RRSP and TSFA in a global perspective of your assets. Using the various saving plans or deferred taxes, here is an explanation that will enlighten you.

Pay your debts

If you take into account that the credit cards rates vary between 18 and 28%, it is a very good deal to pay your balance entirely or, at least, as much as possible. It is money falling from the sky that can easily be recovered. What good is a 5% interests rate if you pay 22% on your debt?

Emergency Fund

Constituting an emergency fund equivalent to 3-6 months of income is not a luxury but a necessary precaution that may prove lifesaving in case of job loss, illness, accident or unexpected events.

RRSP

On the third level of my hierarchy of priorities, I place the RRSP contribution. The RRSP can be used for short and medium term projects such as buying a new home or going back to school (LLP). The RAP program offers to access it up to $25,000 tax-free and repayable over 15 years (without paying for the two first years). If you already have a house, the RRSP will be used for retirement. If you have children or dependents, having protection in case of disability and death would also be very appropriate at this stage.

RESP

The RESP is still very attractive and in many circumstances, it exceeds the benefits of a TFSA. The 20% subsidy and the various studies tokens offer a significant added value. A contribution to grandchildren or nephews can also satisfy your need to transfer assets.

TFSA

The TFSA seems far from the base but if your marginal rate is very low, it may be more adequate to use it in place or the RRSP. Usually, the TSFA aims to supply a bonus to other plans or to be used for a specific project. A cottage? A second car? A trip to Europe? The only limit is your imagination.

Mortgage

The prepayment of your mortgage can be done with the tax savings of the RRSP or with the excess saving capacity. Don’t forget that when the rates are low, this debt is not as urgent to pay off as your credit cards. What matters the most is your net worth. Your assets MINUS your debts = your NET worth. If it grows, you are on the right track.